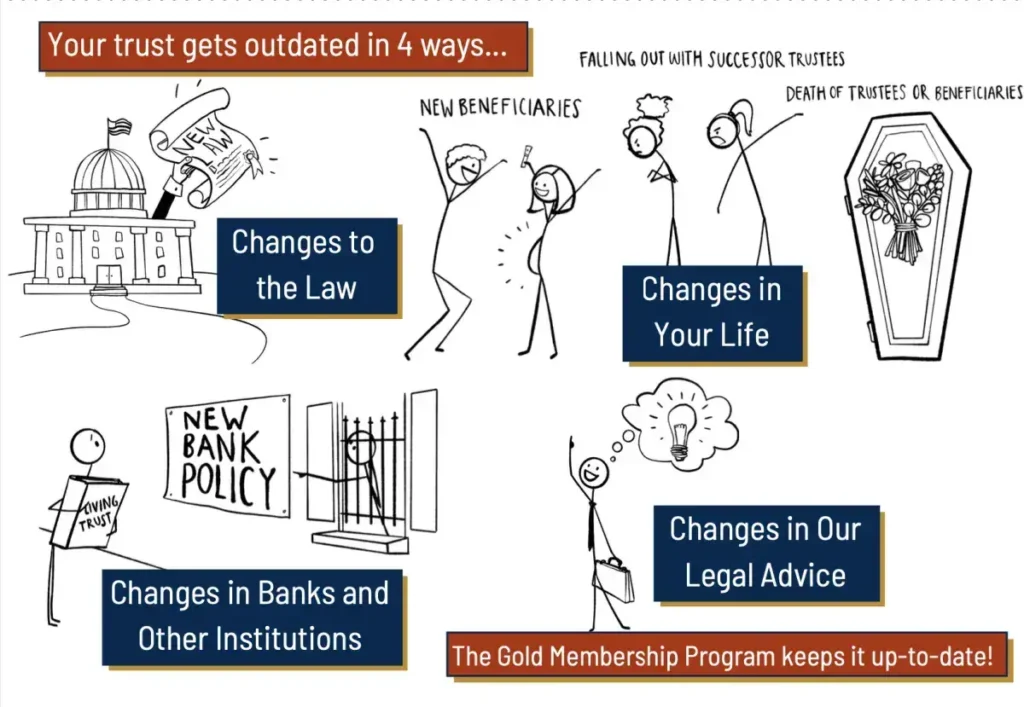

Yep, your living trust will get outdated.

If someone tells you your living trust won’t get outdated, they don’t know what they’re talking about. So what does change that will cause your plan to get outdated?

First, the laws will change.

That is guaranteed.

Just in the last couple of years, the income tax law changed, the gift tax law changed, the estate tax law changed. Laws for probate and adult guardianship court changed. Disinheritance law changes. The laws for health care and financial powers of attorney changed…laws change all the time.

And when the law changes you’re expected to know about it because ignorance of the law is no excuse for not obeying the law. And if the law changes and you don’t know about it then you can really get into trouble

I had a client who was also an attorney and I explained that I have a Gold Membership Program that can make sure he is notified when the trust laws change. But he said, “well, I don’t want that because I’ll just look up the laws myself…I am, after all, an attorney he said.”

A few years later, he called me and said his wife had died and he wanted to know what to do next. But here’s the problem. The year after I drafted his trust, the tax laws changed significantly.

His plan was outdated and, as a result, he lost control of part of his assets. He didn’t know the law had changed so he never got his living trust updated.

And even if he did know the law changed, he is not going to know how the law change can impact Section 9.05 of his trust unless he focuses his practice on preparing living trusts. Had he been a part of my membership program, this would not have happened to him.

OK, so what else will change that will cause your living trust to get outdated?

The banks, the doctors and the financial institutions will change. That is also guaranteed to happen. These banks, doctors, and lenders may not choose to accept a power of attorney or your living trust if they change their company policies. Your documents need to be in compliance with their policy changes. Their policies are always more restrictive than the law and they change more often than the law.

What else will change that will cause your plan to get outdated?

Your life changing. What if you have a new baby or grandchild?

Your plan is now outdated.

What happens if your relationships change and you have a falling out with your successor trustee or your health care agent or your financial power of attorney agent or your beneficiary. You may not want their help anymore. You may not want them to get your assets anymore after your death. But you still have them listed in your plan.

Your plan is now outdated.

What happens if your successor trustee or your beneficiary dies? Your plan is now outdated. You might be thinking: “oh, when my life changes I’ll just call the attorney and get it updated.”

Maybe.

But I’ve reviewed thousands of trusts over the last 18 years. I’m here to tell you that you probably won’t call the attorney because you forget or don’t want to be charged $800 or more for the amendments. So your outdated documents just sit there and when you die, the wrong people are in charge and the wrong people got your money.

Our one-of-a-kind Gold Membership Program provides continuous support to ensure that your documents are up to date and that you are operating the plan correctly.

No more reliance on documents that may or may not protect you and your loved ones.

The Gold Membership Program provides you peace of mind that your plan is always accurate, up-to-date, and works the way you intended.