Are you worried about what would happen to your assets and loved ones if something happened to you? Surely, your estate planning can secure your assets and fulfill all your wishes. Without an effective estate plan, the court will decide it all. In this situation, your family could face long delays, expensive legal fees, and long-term stress.

So, what is estate planning?

Estate planning is a well-crafted legal plan that can help you avoid probate, reduce taxes, and control the distribution of your assets. Usually, it includes trusts, powers of attorney, and healthcare directives to cover all vital aspects of your future. Estate planning is essential for anyone to protect their family.

With Fales Law Group, you can be sure that all your estate planning needs are in the right hands. Our experienced attorney will guide you through every estate planning step with the latest law updates.

Contact us for a free consultation today!

In this blog, we’ll discuss estate planning and its significance with the 10 most important facts.

What Is Estate Planning?

Estate planning decides what should happen to your assets and family when you pass away or cannot manage them on your own. It’s essential for protecting your family, reducing stress, and avoiding unnecessary legal hassles.

You can have an estate plan if you own a home, have savings, or care about who inherits your belongings. Estate planning becomes more important for young children and your business. You can also avoid family disputes over property and assets.

Why Is Estate Planning Important?

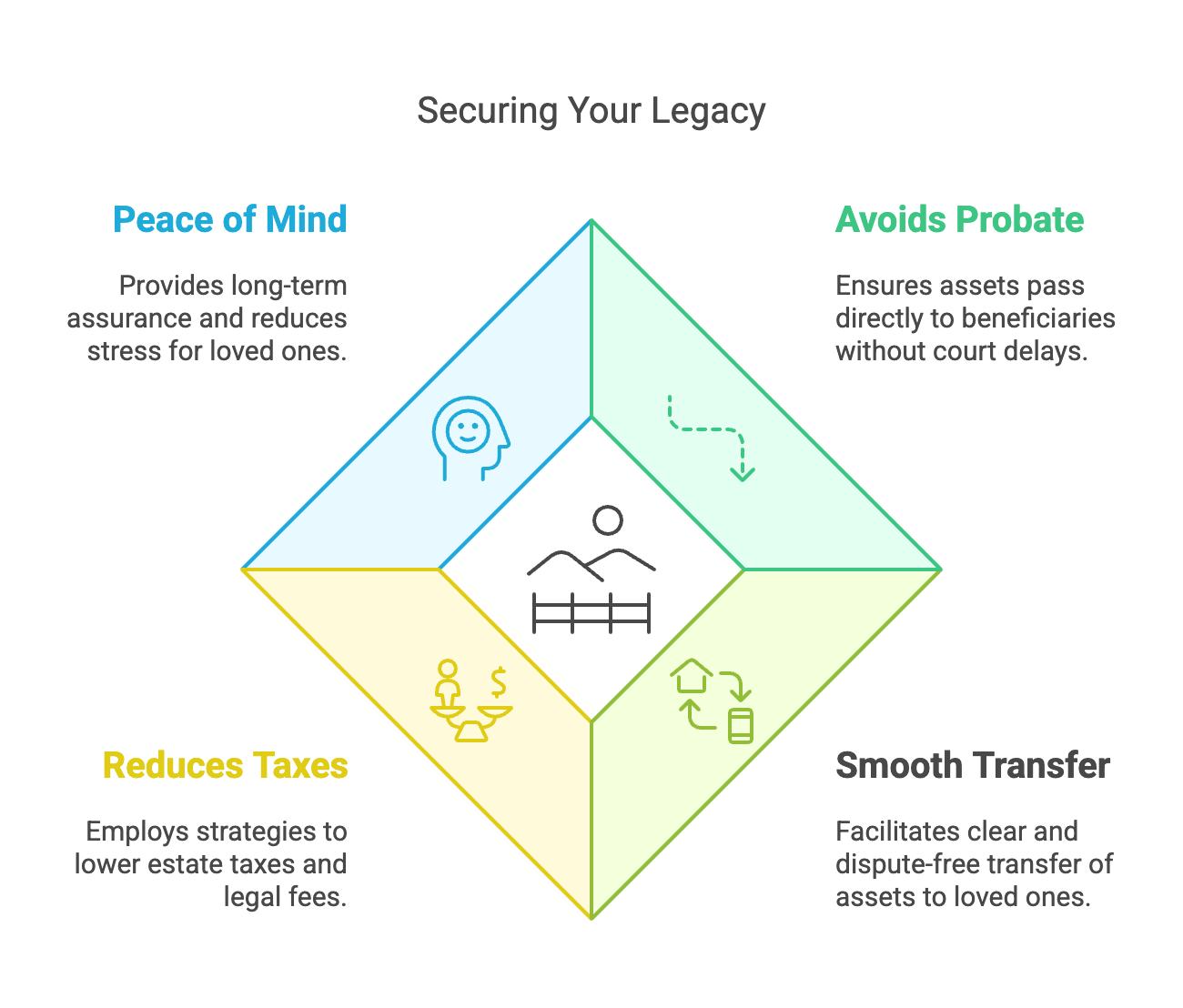

Here’s how estate planning is important:

- Avoids Probate and Court Delays: With a well-structured estate plan, assets can be passed directly to beneficiaries without court involvement. This saves time, money, and stress.

- Smooth Transfer of Assets: A proper estate plan eliminates confusion and prevents disputes. It also ensures the best care for your spouse, children, or other loved ones.

- Reduces Estate Taxes and Legal Fees: Some strategies, like gifting assets can lower taxable value and minimize legal fees. Without planning, your estate may face high taxes and legal fees.

- Peace of Mind for the Future: The biggest benefit of estate planning is long-term peace of mind. Your loved ones won’t have to deal with unnecessary stress and everything will be handled exactly as you want.

10 Must-Know Facts About Estate Planning

Here are 10 facts you need to know about estate planning to ensure your wishes are carried out smoothly:

1. Estate Planning Is More Than a Will

Your Will helps distribute your assets but won’t avoid probate or the legal process of settling your estate. However, your complete estate plan includes these factors:

- A trust to avoid probate and provide better asset control

- A power of attorney to manage finances if you become incapacitated

- A healthcare directive to make medical decisions easier for your family

2. Everyone Needs an Estate Plan, Not Just the Rich

You need an estate plan if you own a home, a bank account, or personal belongings. Everyone can confirm their assets go to the right people with minimal hassle through estate planning. It’s especially important if you have children who need guardianship.

3. Without a Plan, the Court Decides

Your assets will go through probate court if you leave without an estate plan. In this situation, state laws decide who gets what from your legacy. However, your estate plan lets you decide who inherits your money and property.

4. Estate Planning Avoids Probate

A living trust can pass your assets directly to your beneficiaries without going through probate. Your trust can save your family time and money in the long run. Trusts also offer more privacy, faster asset access, and better control over asset distribution.

5. Naming Beneficiaries Correctly

Your life insurance policies, retirement accounts, and bank accounts require you to name beneficiaries. These accounts pass directly to the named beneficiary. You can make sure your beneficiary designations are up to date to avoid legal issues.

6. Power of Attorney Protects

Your power of attorney is a trusted person to handle your financial matters if you become incapacitated. Without a POA, your loved ones may have to go to court to get legal authority. This way, managing your finances will be a costly and time-consuming process.

7. Healthcare Directive for Medical Wishes

A healthcare directive tells doctors and family members about medical treatments you do or don’t want if you can’t communicate in any situation. It’s one of the most important estate planning documents you can have. This document prevents family conflicts over medical decisions.

8. Estate Planning Can Reduce Taxes

It’s always a smart way to plan and minimize the tax burden on your loved ones. Estate planning services can reduce taxes by setting up trusts to manage wealth efficiently. You can also use gift exemptions and take advantage of spousal and charitable deductions.

9. Keeping Your Estate Plan Updated Is Essential

Not timely updating your estate plan can lead to outdated or invalid documents. Updating your plan reflects your current wishes and protects your loved ones. Moreover, you can review your estate plan if you experience the following:

- Marriage or divorce

- Birth or adoption of a child

- Death of a beneficiary or trustee

- Financial changes, like buying a home

10. Consulting an Estate Planning Attorney

A small but wise investment in professional help can save your loved ones from major financial and legal troubles. An estate planning attorney can make sure your documents comply with state laws. You can choose the best strategies to protect your assets and make sure your plan is legally sound and effective.

Need Professional Estate Planning to Secure Your Legacy

Estate planning is an excellent step to protect your family, assets, and legacy. Without a plan, your loved ones could face stressful legal issues, high taxes, and delays in receiving their shares. However, the right estate plan can control all the matters effortlessly.

Our experienced estate planning attorney can help you in estate planning and avoiding probate. Fales Law Group focuses on customized estate plans that give you peace of mind and protect your legacy. Schedule a free consultation and start building a foolproof estate plan now!

Common Questions

Frequently Asked Questions

What is estate planning?

Estate planning involves creating a legal strategy to manage and distribute your assets upon your death or if you become incapacitated. It ensures your wishes are honored, helps avoid probate, reduces taxes, and provides for your loved ones.

Is estate planning only necessary for the wealthy?

No, estate planning is important for everyone, regardless of wealth. If you own property, have savings, or possess personal belongings, an estate plan ensures your assets are distributed according to your wishes and can designate guardians for minor children.

What happens if I don't have an estate plan?

Without an estate plan, your assets will go through probate court, and state laws will determine their distribution. This process can lead to delays, increased legal fees, and outcomes that may not align with your preferences.

How does a living trust help in estate planning?

A living trust allows your assets to pass directly to beneficiaries without going through probate. This arrangement saves time and money, offers privacy, and provides better control over how and when your assets are distributed.

Why is it important to have a power of attorney in my estate plan?

A power of attorney designates a trusted individual to manage your financial affairs if you become incapacitated. Without this designation, your loved ones may face legal challenges and delays in handling your financial matters.