Proper trust funding is essential to protect your assets and ensure they’re passed down smoothly to your heirs. However, things can turn in the wrong direction if you fail to fund your trust accurately. Funding a trust requires transferring ownership of your assets in your trust to keep them legally protected. If you skip this step, your estate can go through probate and destroy the trust’s purpose in the first place.

Fales Law Group makes choices and the process easier for you. You can trust our estate planning attorney for exceptional assistance in every matter of trust funding. Contact us for a free consultation now!

This blog post will discuss a simple checklist of seven must-do tasks to keep the process in your favor.

7 Must-Do Tasks for a Worry-Free Trust Funding Process

Imagine you’ve set up a trust to protect your family’s future, but without proper trust funding, it’s just a piece of paper that can’t deliver on its promise—millions of Americans face this reality when they overlook this crucial step. Trust funding, the process of transferring your assets into a trust, is the key to ensuring your estate avoids probate, your wealth is managed as you intend, and your loved ones are spared unnecessary stress.

Here are 7 must-do tasks for a worry-free trust-funding process:

1. Retitle Real Estate into the Trust

You must transfer the title to your trust if you own property. This usually means filing a new deed with your county recorder’s office. Your attorney will create a quitclaim deed or warranty deed that names the trust as the new owner.

If you have a mortgage, check with your lender to make sure the transfer won’t trigger any issues. You must keep a copy of the updated deed in your estate planning records.

2. Transfer Bank and Investment Accounts

For bank accounts, you can retitle the account in the trust’s name or keep it in your name but designate the trust as the POD beneficiary. However, you need a different strategy for investing in stocks or brokerage accounts.

Some institutions allow you to retitle assets in the trust’s name, but others may require you to list the trust as a transfer-on-death (TOD) beneficiary. You should check with your bank to make sure your accounts are properly linked to the trust.

3. Assign Business Interests to the Trust

If you own an LLC or corporation, you must update your operating agreement or corporate records to reflect the trust as the owner. Assets with partnerships require approval from your co-owners before making the transfer.

Business ownership can be more tricky than other asset transfers. So, it’s a good idea to work with an estate planning attorney to make sure everything is set up correctly.

4. Update Life Insurance and Retirement Account Beneficiaries

Some assets, like life insurance and retirement accounts 401(k), IRAs, don’t go directly into a trust like other assets do. Instead, you update the beneficiary designation forms to name the trust as a beneficiary.

Listing the trust as the beneficiary can control payouts and distributions for life insurance policies. This method is particularly effective for minor children or dependents with special needs.

Simply naming a trust as the beneficiary for retirement accounts can be complicated. It can also cause tax consequences. So you must check with a financial advisor before making significant changes.

5. Secure Personal Property and Valuable Items

You can include your smaller assets, like jewelry, collectibles, and family heirlooms, in a trust. You can easily handle this by creating a personal property memorandum and a legal document listing items. Transferring ownership of high-value items like cars or art collections directly into the trust also helps in some cases. This way, you can ensure your valuable items go exactly where you want them without confusion or mismanagement.

6. Review and Update Regularly

Special or major life events like marriage, divorce, births, deaths, or significant financial changes can affect your estate plan and trust funding requirements. Proper and regular review keeps your trust updated with adequate funding. Also, you should double-check that your trustees and beneficiaries are still the right choices after any life event. Your estate planning attorney can provide the right assistance in this situation.

7. Notify Relevant Parties and Keep Documents Accessible

After everything is set up and properly funding your trust, you must make sure that all relevant people know about your trust funding. Your well-funded trust works best when all parties know the related and updated information. For this:

- Your successor trustee should have copies of the trust documents

- Your financial institutions should have updated account titles and beneficiary forms

- Original trust documents should be secure but accessible in a fireproof safe or with your attorney

Why Identify Your Transferable Assets First?

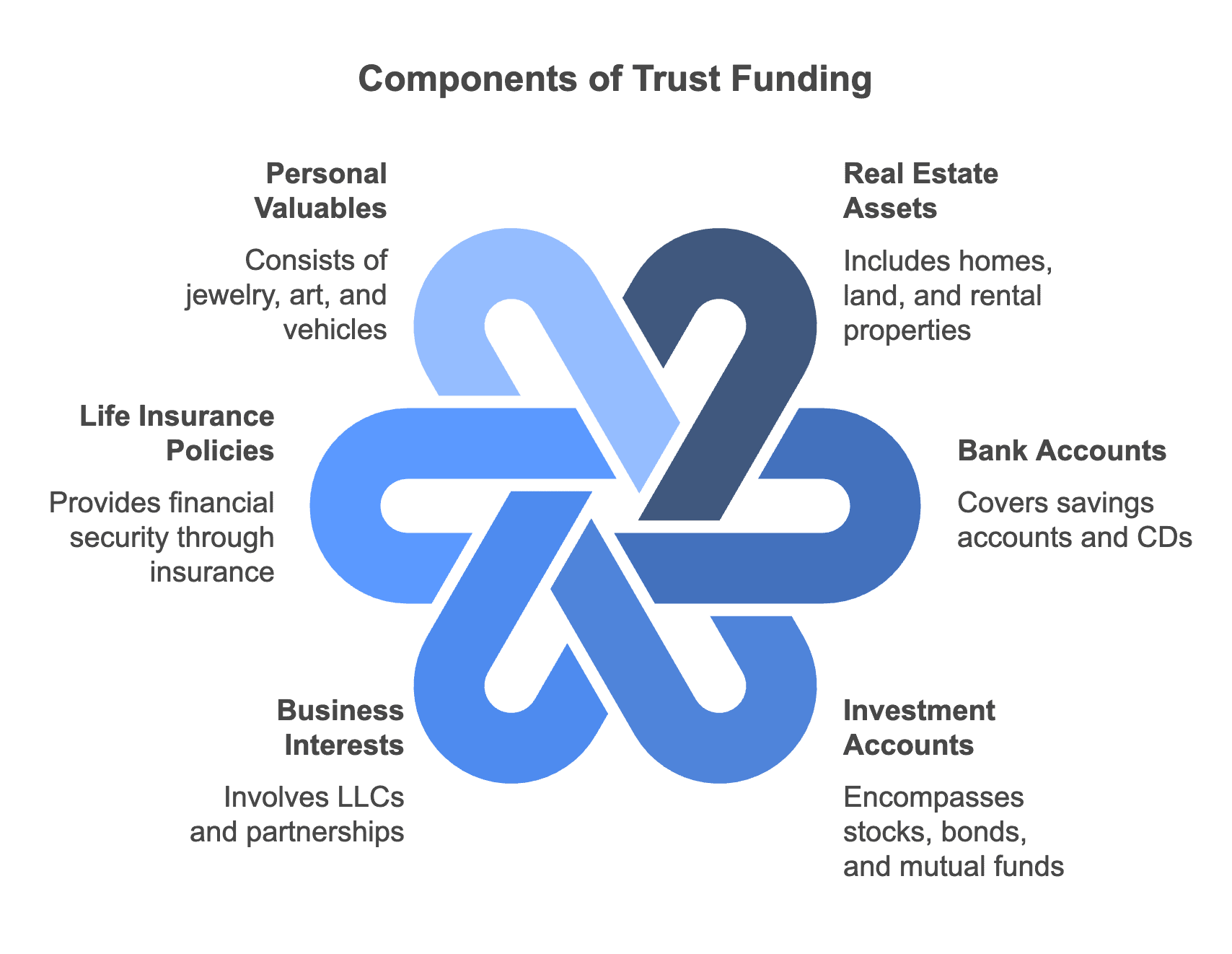

For proper trust funding, you must know exactly what you own and what needs to go into the trust. Without adequate information and consideration, you can’t expect the best results. Also, any misunderstanding or mismanagement can affect the purpose of your trust. You can safely start the process by listing all your assets. You can consider the following assets for trust funding:

- Real estate assets like homes, land, rental properties

- Bank accounts, savings accounts, CDs

- Investment accounts like stocks, bonds, mutual funds

- Business interests, LLCs, partnerships

- Life insurance policies

- Personal valuable assets like jewelry, art, vehicles

Secure Your Legacy with Professional Trust Funding Techniques

Funding your trust is an ongoing process with proper understanding and regular reviews. We are confident that this checklist can make sure your trust is properly set up and well-funded and can avoid costly legal issues down the road. Trust funding is essential to protect your assets and loved ones from unnecessary legal hassles.

Fales Law Group’s experienced estate planning attorney can make the trust-funding process much safer and easier for you. Working with the right professionals means your loved ones will have a smooth asset transition experience when the time comes.

With years of estate planning experience, our attorney provides personalized guidance to make sure your trust is fully funded and legally sound. We understand the complexities of asset transfers, business ownership, and beneficiary designations. Schedule a free consultation today and take the next step toward a worry-free future!

Common Questions

Frequently Asked Questions

What are the main types of living trusts, and how do they differ?

There are two primary types of living trusts:

- Revocable Living Trust: Allows you to retain full control over your assets during your lifetime, with the flexibility to modify or revoke the trust as your circumstances change.

- Irrevocable Living Trust: Once established, this trust cannot be altered or revoked, effectively removing the assets from your estate, which can offer protection from creditors and potential estate tax benefits.

Who should I designate as the trustee and beneficiaries of my living trust?

As the grantor, you can serve as the initial trustee, maintaining control over your assets. It’s essential to appoint a successor trustee who will manage the trust upon your incapacity or death. Beneficiaries are individuals or entities you designate to receive the assets held in the trust.

What types of assets can be placed into a living trust?

A living trust can include various assets, such as:

- Real Estate: Primary residences, vacation homes, and rental properties.

- Bank Accounts: Checking, savings, and money market accounts.

- Investments: Stocks, bonds, mutual funds, and other investment accounts.

- Business Ownership: Interests in privately owned businesses.

Personal Property: Valuable items like jewelry, artwork, and collectibles.

What are common mistakes to avoid when setting up a living trust?

Common pitfalls include:

- Not Funding the Trust: Failing to transfer assets into the trust renders it ineffective.

- Choosing the Wrong Trustee: Selecting an unreliable or unqualified trustee can lead to mismanagement.

- Neglecting to Update the Trust: Not revising the trust to reflect life changes can cause discrepancies.

- Improper Execution: Not signing the trust document in accordance with state laws can invalidate the trust.

- Overlooking Tax Implications: Not considering potential tax consequences can affect the estate’s value.

Why is it important to consult with an estate planning attorney when creating a living trust?

An estate planning attorney ensures that your living trust is tailored to your specific needs, complies with state laws, and helps you avoid common mistakes that could undermine your estate planning goals.