What happens to your assets after you’re gone?

Imagine you’ve spent a lifetime building a legacy- savings, property, investments– only to leave its fate uncertain. This is where a testamentary trust comes in. A testamentary trust is a legal arrangement created through your will, designed to spring into action after your death. It’s a powerful tool that ensures your hard-earned assets are protected, your loved ones are provided for, and your wishes are carried out exactly as you intended.

Setting up a testamentary trust isn’t complicated with the right guidance. You can set it up to secure your legacy. Fales Law Group is your trusted go-to for setting up a testamentary trust in a stress-free way. We provide the highest level of protection to your trust from all potential issues. Schedule a free consultation today and move forward with confidence.

In this article, we’ll discuss five simple steps to guide you through the purpose, benefits, and process of setting up a testamentary trust.

What is a Testamentary Trust?

A testamentary trust is a unique estate planning tool established through a will, designed to take effect only after the grantor—the person creating the trust—passes away. Unlike other financial arrangements, a testamentary trust doesn’t exist during the grantor’s lifetime; it’s a blueprint laid out in the will that activates upon death. This makes it an appealing option for those who want to maintain full control over their assets while alive yet ensure a structured plan for the future.

To understand how a testamentary trust differs from other trusts, consider the contrast with a living trust. A living trust is created and active during the grantor’s lifetime, often bypassing probate, while a testamentary trust only comes into play post-mortem, requiring probate to be funded. This fundamental difference shapes its purpose and application in estate planning.

Every testamentary trust involves the following key players: the grantor, who outlines the trust in their will; the trustee, appointed to manage the trust’s assets according to its terms; and the beneficiaries, the individuals or entities (like children or charities) who receive the benefits.

For example, a parent might set up a testamentary trust to provide for their minor children, with a trusted sibling as the trustee overseeing funds until the kids reach adulthood.

Legally, a testamentary trust operates under the oversight of a probate court and is governed by state laws, ensuring compliance with the grantor’s wishes. This court involvement distinguishes it from trusts that avoid probate entirely. While this adds a layer of process, it also offers a safeguard, ensuring the trust is executed as intended. In short, a testamentary trust differs from other trusts because it balances posthumous control with legal structure, making it a tailored solution for many.

Tax Implications of Testamentary Trusts

A testamentary trust is taxed as a separate legal entity, meaning it files its tax return (Form 1041). Any income the trust earns is subject to high trust tax rates unless distributed to beneficiaries, who then pay at their tax rates.

Estates over the $13.61 million limit may owe federal estate tax. Using spousal exemptions or gifting assets can reduce this. Distributing income to beneficiaries lowers the trust’s tax burden. Investing in tax-efficient assets like municipal bonds also helps in this process.

Is a Testamentary Trust Right for You?

Deciding whether a testamentary trust fits your estate plan depends on your unique circumstances. This tool is ideal for specific groups, particularly parents of young children who want to ensure their kids are financially secure until they’re mature enough to manage an inheritance. A testamentary trust shines in these cases, allowing you to appoint a trustee to oversee funds until a set age, like 25. It’s also perfect for individuals with complex family dynamics—think blended families or estranged relatives—where a structured inheritance can prevent disputes. Likewise, if you desire control over how your assets are distributed, such as staggered payments to a spendthrift beneficiary, a testamentary trust offers that precision.

Setting one up is straightforward but requires care. Start by consulting a professional attorney to discuss your goals and ensure legal compliance. Next, draft a will that clearly outlines the testamentary trust, including the trustee, beneficiaries, and specific terms—like when or how assets are released. This process ensures your wishes are ironclad and tailored to your needs.

If you’re considering a testamentary trust, start by assessing your goals:

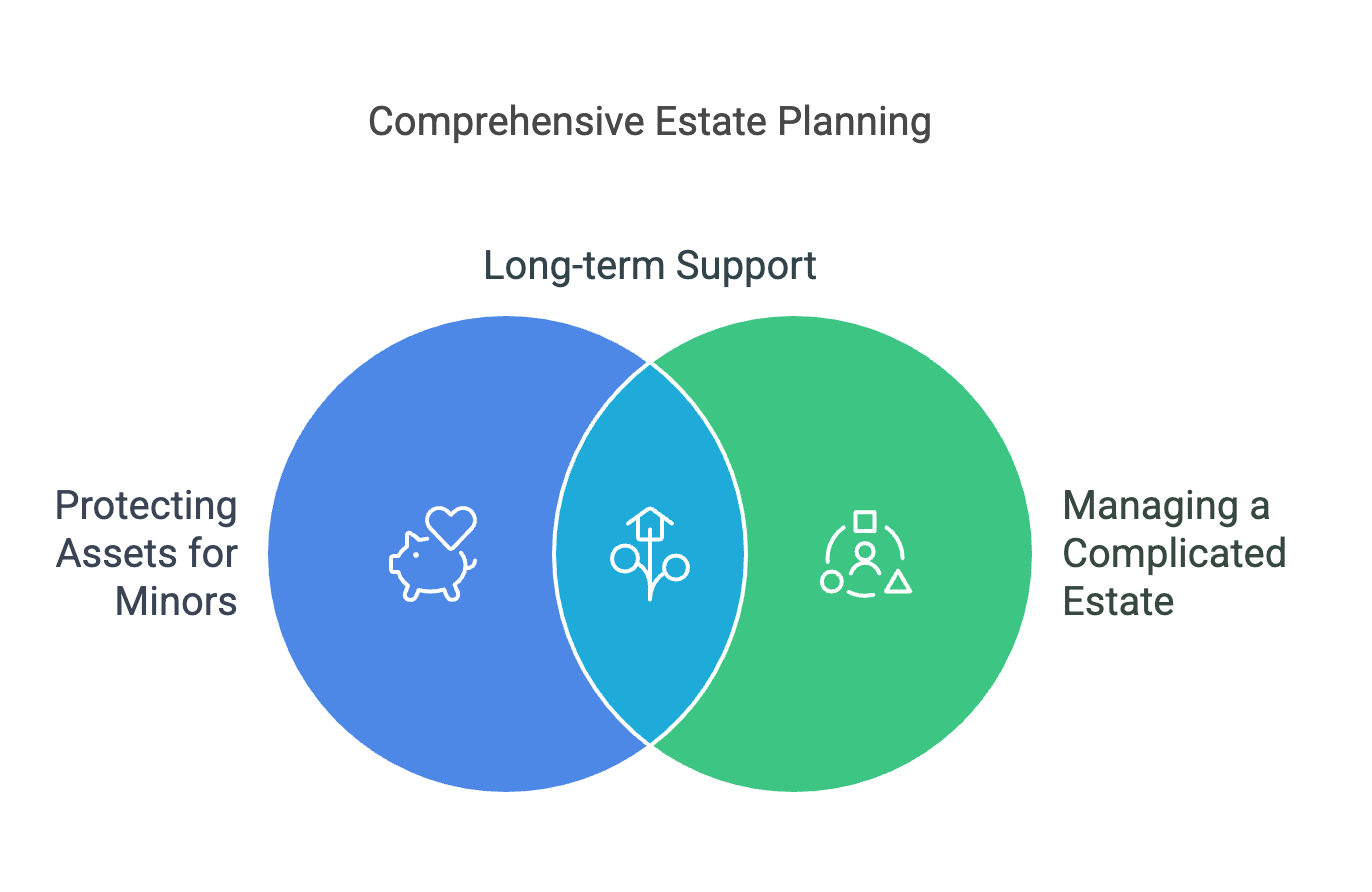

- Do you need to protect assets for minors?

- Manage a complicated estate?

- Provide long-term support?

Evaluating these questions can clarify if it’s the right fit. For personalized guidance, seek professional advice from an attorney who can align the trust with your vision. A testamentary trust isn’t for everyone, but for the right person, it’s a powerful way to secure a legacy.

5 Steps to Set Up a Testamentary Trust

Planning for the future means ensuring your assets are protected and your loved ones are cared for, even after you’re gone. A testamentary trust offers a smart way to achieve this, allowing you to dictate how your estate is managed and distributed through your will. But how do you get started? Here are five straightforward steps to establish a testamentary trust, from defining your goals to finalizing the details, so your legacy unfolds exactly as you envision.

1. Understand the Purpose and Benefits of a Testamentary Trust

You need to understand how a testamentary trust works and why it can be useful for your estate plan. A testamentary trust holds and distributes your assets according to the instructions in your will. Since it only takes effect after your death, it must go through probate court before it becomes active.

This type of trust is especially useful if you have young children who are not ready to manage money. You can protect assets from creditors, lawsuits, or divorce settlements. It’s also helpful to provide ongoing financial support for a special needs family member. It can provide tax benefits for heirs and legal protection for your family’s inheritance.

2. Draft a Will That Includes Testamentary Trust Provisions

A testamentary trust must be included in your last will. Without a will, the court will decide how to distribute your assets, and that may not align with your wishes. The trust is funded by the assets you leave behind, such as savings and investment accounts, life insurance policies, real estate, etc. Your will should clearly state the name of the trustee, beneficiaries, and rules for distributing assets.

3. Choose a Trustee and Define Their Role

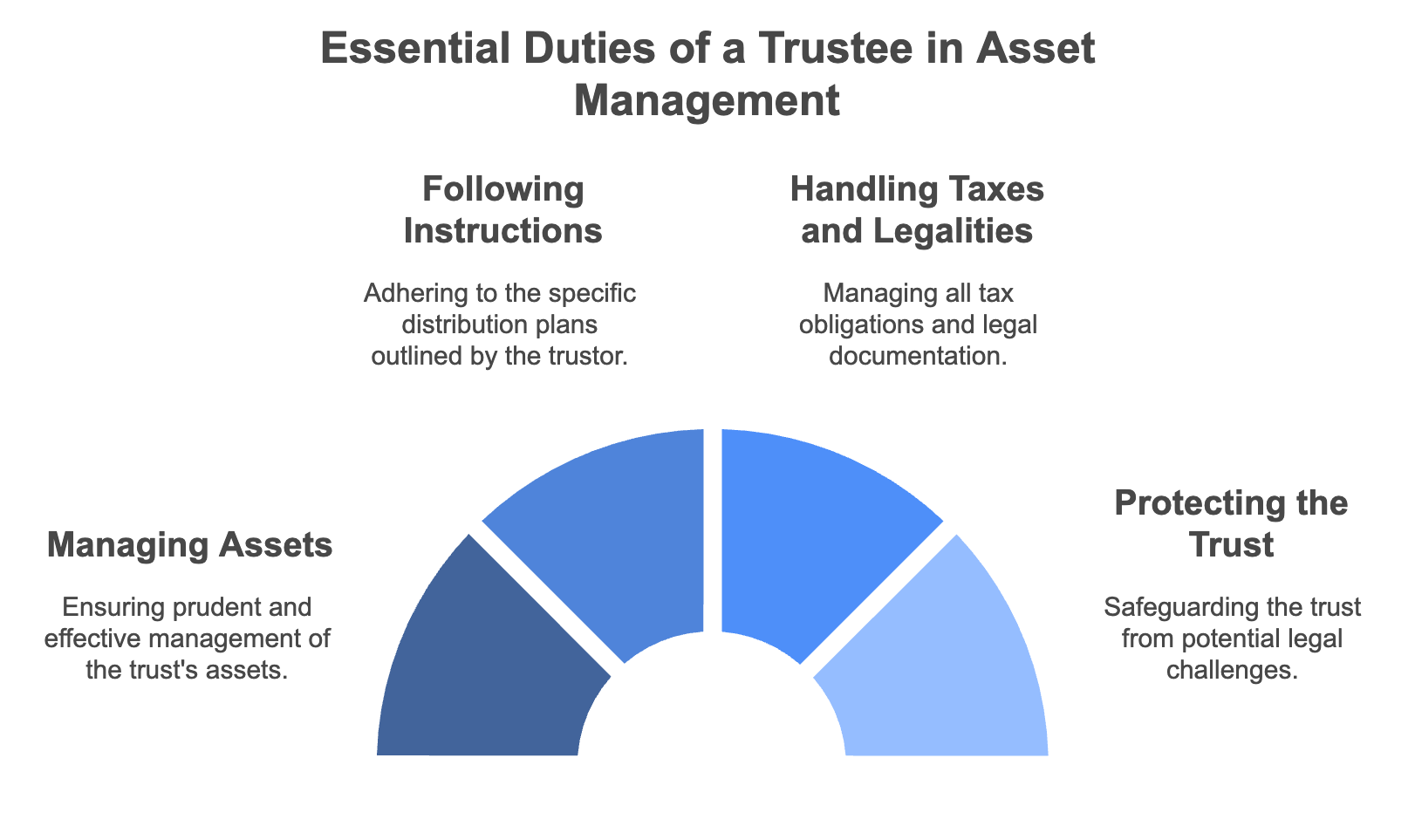

The trustee is responsible for managing and distributing the assets according to your wishes and last will. For this responsibility, you should choose a family member or friend who is responsible and comfortable handling finances. If your estate is large or complicated, hiring a professional trustee is a better option. A trustee has the following essential responsibilities:

- Managing the assets wisely

- Following your instructions for distribution

- Handling taxes and legal paperwork

- Protecting the trust from legal disputes

4. Identify Beneficiaries and Set Distribution Rules

A testamentary trust can control when and how your beneficiaries receive their inheritance. Beneficiaries of a testamentary trust include children, a spouse, family members with special needs, and charities. You can specify that beneficiaries receive lump sum payments at a particular age, like 50% at age 25 and the remaining at age 35. You can set up annual or monthly allowances for their daily expenses. Conditional payments for specific needs like education, medical care, or home purchases can also be included in a testamentary trust.

5. Review, Update, and Formalize Your Trust

Once your testamentary trust is in place, it’s important to keep it updated as your life changes. Talking to your beneficiaries and trustees about your wishes can prevent misunderstandings and ensure a smooth transition when the time comes. You should update your testamentary trust after the following events:

- Marriage or divorce in your family

- Birth of new children or grandchildren

- Changes in financial situation

- Changes in tax laws of your state

Need to Set Up a Testamentary Trust Without Hassle?

Setting up a testamentary trust isn’t a big deal when you understand its purpose and benefits. You can draft a will that includes trust provisions of your choice. A trustee will manage and distribute assets. A testamentary trust identifies beneficiaries and sets clear rules for distribution. A well-planned testamentary trust can provide financial security and peace of mind for your loved ones.

Fales Law Group can provide reliable solutions to protect your legacy for your loved ones. You can control the distribution and secure the future. Contact us today to successfully set up a testamentary trust straight away.

Common Questions

Frequently Asked Questions

What are the main types of living trusts, and how do they differ?

There are two primary types of living trusts:

- Revocable Living Trust: Allows you to retain full control over your assets during your lifetime, with the flexibility to modify or revoke the trust as your circumstances change.

- Irrevocable Living Trust: Once established, this trust cannot be altered or revoked, effectively removing the assets from your estate, which can offer protection from creditors and potential estate tax benefits.

Who should I designate as the trustee and beneficiaries of my living trust?

As the grantor, you can serve as the initial trustee, maintaining control over your assets. It’s essential to appoint a successor trustee who will manage the trust upon your incapacity or death. Beneficiaries are individuals or entities you designate to receive the assets held in the trust.

What types of assets can be placed into a living trust?

A living trust can include various assets, such as:

- Real Estate: Primary residences, vacation homes, and rental properties.

- Bank Accounts: Checking, savings, and money market accounts.

- Investments: Stocks, bonds, mutual funds, and other investment accounts.

- Business Ownership: Interests in privately owned businesses.

Personal Property: Valuable items like jewelry, artwork, and collectibles.

What are common mistakes to avoid when setting up a living trust?

Common pitfalls include:

- Not Funding the Trust: Failing to transfer assets into the trust renders it ineffective.

- Choosing the Wrong Trustee: Selecting an unreliable or unqualified trustee can lead to mismanagement.

- Neglecting to Update the Trust: Not revising the trust to reflect life changes can cause discrepancies.

- Improper Execution: Not signing the trust document in accordance with state laws can invalidate the trust.

- Overlooking Tax Implications: Not considering potential tax consequences can affect the estate’s value.

Why is it important to consult with an estate planning attorney when creating a living trust?

An estate planning attorney ensures that your living trust is tailored to your specific needs, complies with state laws, and helps you avoid common mistakes that could undermine your estate planning goals.