Did you know that millions of Americans use trusts to safeguard their wealth and secure their legacies?

Transferring assets to a trust is a powerful estate planning tool that protects your property, money, or valuables, helping you avoid probate, ensure they’re managed according to your wishes, and even unlock tax benefits for your heirs.

Fales Law Group provides all necessary assistance to successfully make a trust and fund it as you wish. You can make the process worry-free with our professional excellence. Schedule a free consultation today!

In this article, we will discuss what trust is, the types of assets you can transfer to a trust, and the proper ways of transferring assets to a trust.

What Is a Trust and Why Transfer Assets?

A trust is a legal entity designed to hold and manage assets for beneficiaries, offering a smart way to organize your estate, whether it’s cash, property, or personal belongings, under the oversight of a trustee who follows your directives. Transferring assets to a trust comes with significant benefits: it lets you bypass probate—the costly, public process of settling an estate—while giving you precise control over how your wealth is distributed, such as to heirs or charities, and it can shield those assets from creditors or lawsuits, preserving your legacy. Trusts come in different forms, like revocable trusts, which you can alter anytime, providing flexibility, and irrevocable trusts, which lock in your assets for enhanced protection and tax advantages, setting the context for why you should know how to transfer assets to a trust. Ultimately, transferring assets to a trust isn’t just about legal paperwork—it’s about securing peace of mind and ensuring your wishes endure.

Types of Assets You Can Transfer to a Trust

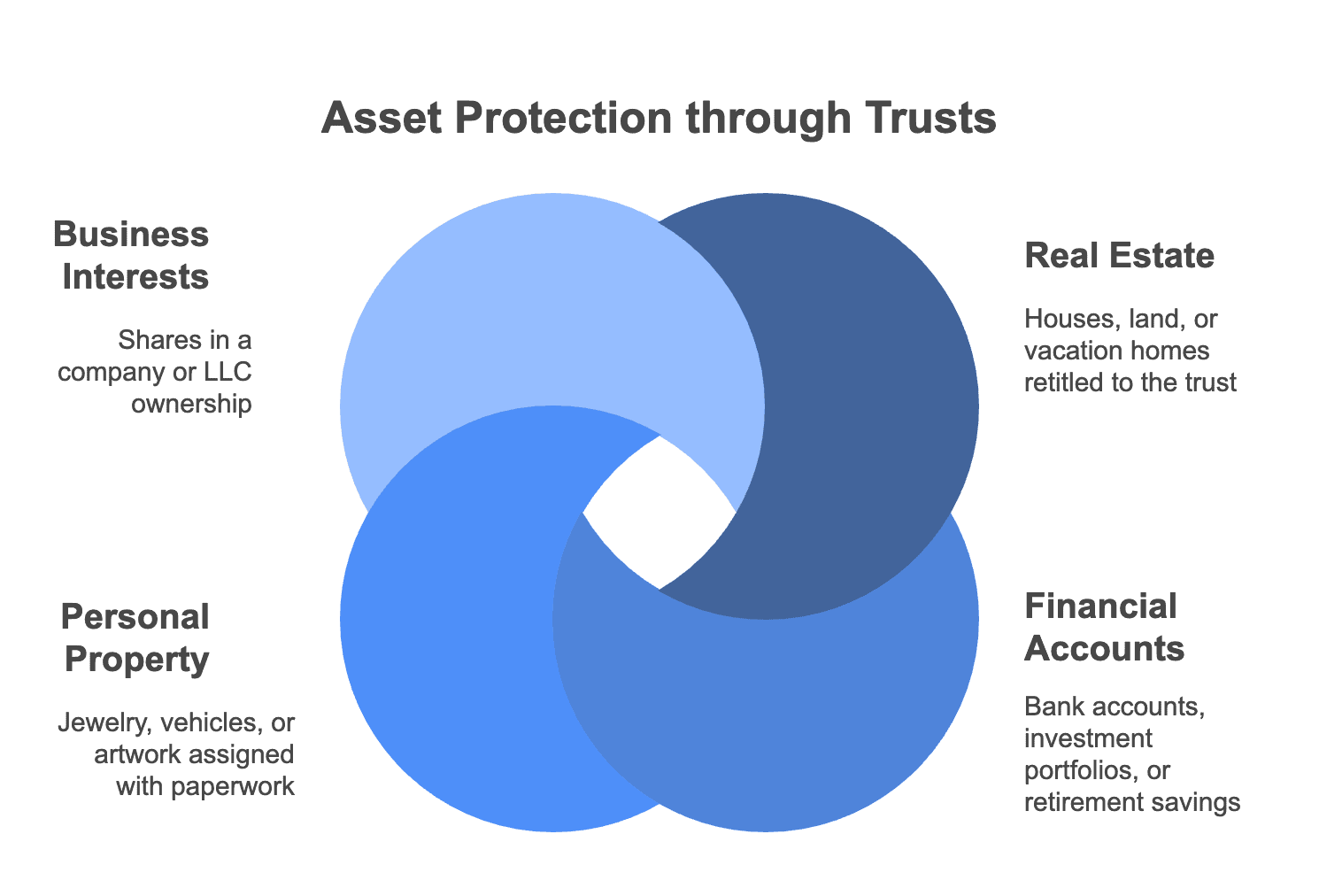

When learning how to transfer assets to a trust, it’s exciting to see just how many parts of your wealth can be protected, from properties to personal keepsakes, all tailored to your estate plan. The process covers a wide range, including:

- Real estate: Houses, land, or vacation homes—which you can retitle into the trust’s name

- Financial accounts: For example, bank accounts, investment portfolios, or retirement savings, updated with a quick ownership change

- Personal property: Jewelry, vehicles, or artwork, easily assigned with basic paperwork

- Business interests: Including shares in a company or LLC ownership, transferred to secure your entrepreneurial legacy.

10 Essential Steps to Transfer Assets to a Trust

Imagine securing your family’s future with a plan that protects your home, savings, and prized possessions—millions of Americans are doing just that by transferring assets to a trust. This powerful estate planning strategy not only shields your wealth from probate and ensures it’s distributed according to your wishes, but it can also offer tax advantages and peace of mind.

Here are 10 essential steps to transfer assets to a trust, guiding you through a straightforward process that covers everything from setting up your trust to verifying the transfer is complete.

1. Choose the Right Type of Trust

You must choose the right type of trust before transferring assets. The two main types of trusts are revocable living trusts and irrevocable trusts. You retain control and can change or dissolve your revocable trust anytime. However, you can’t modify irrevocable trusts easily, but it provides more asset protection and potential tax benefits. You can also opt for specialized trusts, like charitable trusts or special needs trusts, for your unique transfer requirements.

2. List the Assets to Transfer

You can’t transfer all your assets in a trust or use the same way. Some transferable assets for a trust are real estate, bank and investment accounts, business interests, vehicles, and valuable personal property, like art, jewelry, and collectibles.

However, you don’t need to transfer retirement accounts IRA, 401(k), health savings accounts (HSAs), and certain annuities with designated beneficiaries. Instead, you can update beneficiary designations for them.

3. Update Ownership for Assets

For assets with titles like property, bank accounts, and vehicles, you’ll update ownership to reflect your trust.

- For real estate: You must prepare a new deed and record it with your county.

- For bank and investment accounts: You can contact your financial institutions to change ownership or assign the trust as the beneficiary.

- For personal vehicles: You should check with your state laws for this. Because only some states allow vehicle transfers into a trust.

4. Reassign Beneficiary Designations

Mostly, you don’t always transfer ownership of your assets like life insurance policies, annuities, and retirement accounts. But you can reassign the beneficiary designations. Additionally, you must name your trust as the primary or contingent beneficiary.

Also, the trust instructions should align with your estate plan to avoid conflicts between beneficiary designations and your will. This proactive strategy prevents problematic consequences, like an ex-spouse receiving your life insurance payout because you forgot to update the beneficiary in your lifetime.

5. Transfer Business Ownership Interests

The transfer of business ownership interests into your trust requires extra steps. For this, you should update LLC operating agreements or corporate shareholder records.

You must make sure the transfer follows your state’s business laws because some transfers could trigger tax implications. Family businesses should also plan for succession for a smooth transition of business ownership.

6. Move Personal Property and Valuable Items

You can also transfer assets without formal titles, like jewelry, art, or collectibles. You can create a trust schedule listing for each item. You need to sign an assignment of ownership document to make it legally part of the trust.

Moreover, your digital assets like domain names, cryptocurrency, or online business accounts can be assigned to your trust with proper legal documentation.

7. Notify All Relevant Parties

It’s also a significant step to notify financial institutions and other involved parties about the transfer of asset ownership.

You should notify banks and brokers so they recognize the trust’s updated ownership. Insurance companies also need to update their policies. You must inform lenders and title companies if real estate is involved in the trust funding.

8. Keep Accurate Records of Transfers

Good recordkeeping always keeps you on the safe side. That’s why you must maintain copies of updated titles and deeds, financial account confirmations, and signed transfer documents. These accurate records eliminate the chances of confusion. Also, give your trustee access to vital documents so they can manage assets smoothly in times of need.

9. Consider Tax and Legal Implications

Sometimes, transferring assets to a trust can have tax consequences. To avoid this, you can consult with an estate planning attorney or tax professional. They help you avoid unintended tax liabilities and guarantee compliance with federal and state laws. You can make the best choices for asset protection as well. In this way, you can prevent costly surprises in hard times.

10. Review and Update Your Trust

You should review your trust after marriage, divorce, or the birth of a child. An outdated trust can create confusion and unintended consequences for your heirs. You should also update after buying or selling your major assets and changes in estate laws that impact your trust.

Need to Control Your Assets Transfer Easily?

Transferring assets into a trust is an essential step in protecting your wealth according to your wishes. You can make the process worry-free with some proactive techniques. You can avoid probate, simplify estate management, and give your family peace of mind.

The professional approach of Fales Law Group makes a huge difference in the success of the process. Our estate planning professional makes sure everything is done correctly.. Contact us for a free consultation now!

Common Questions

Frequently Asked Questions

What are the main types of living trusts, and how do they differ?

There are two primary types of living trusts:

- Revocable Living Trust: Allows you to retain full control over your assets during your lifetime, with the flexibility to modify or revoke the trust as your circumstances change.

- Irrevocable Living Trust: Once established, this trust cannot be altered or revoked, effectively removing the assets from your estate, which can offer protection from creditors and potential estate tax benefits.

Who should I designate as the trustee and beneficiaries of my living trust?

As the grantor, you can serve as the initial trustee, maintaining control over your assets. It’s essential to appoint a successor trustee who will manage the trust upon your incapacity or death. Beneficiaries are individuals or entities you designate to receive the assets held in the trust.

What types of assets can be placed into a living trust?

A living trust can include various assets, such as:

- Real Estate: Primary residences, vacation homes, and rental properties.

- Bank Accounts: Checking, savings, and money market accounts.

- Investments: Stocks, bonds, mutual funds, and other investment accounts.

- Business Ownership: Interests in privately owned businesses.

Personal Property: Valuable items like jewelry, artwork, and collectibles.

What are common mistakes to avoid when setting up a living trust?

Common pitfalls include:

- Not Funding the Trust: Failing to transfer assets into the trust renders it ineffective.

- Choosing the Wrong Trustee: Selecting an unreliable or unqualified trustee can lead to mismanagement.

- Neglecting to Update the Trust: Not revising the trust to reflect life changes can cause discrepancies.

- Improper Execution: Not signing the trust document in accordance with state laws can invalidate the trust.

- Overlooking Tax Implications: Not considering potential tax consequences can affect the estate’s value.

Why is it important to consult with an estate planning attorney when creating a living trust?

An estate planning attorney ensures that your living trust is tailored to your specific needs, complies with state laws, and helps you avoid common mistakes that could undermine your estate planning goals.