Remember the trust is like a bucket and you have to put most of your assets inside.

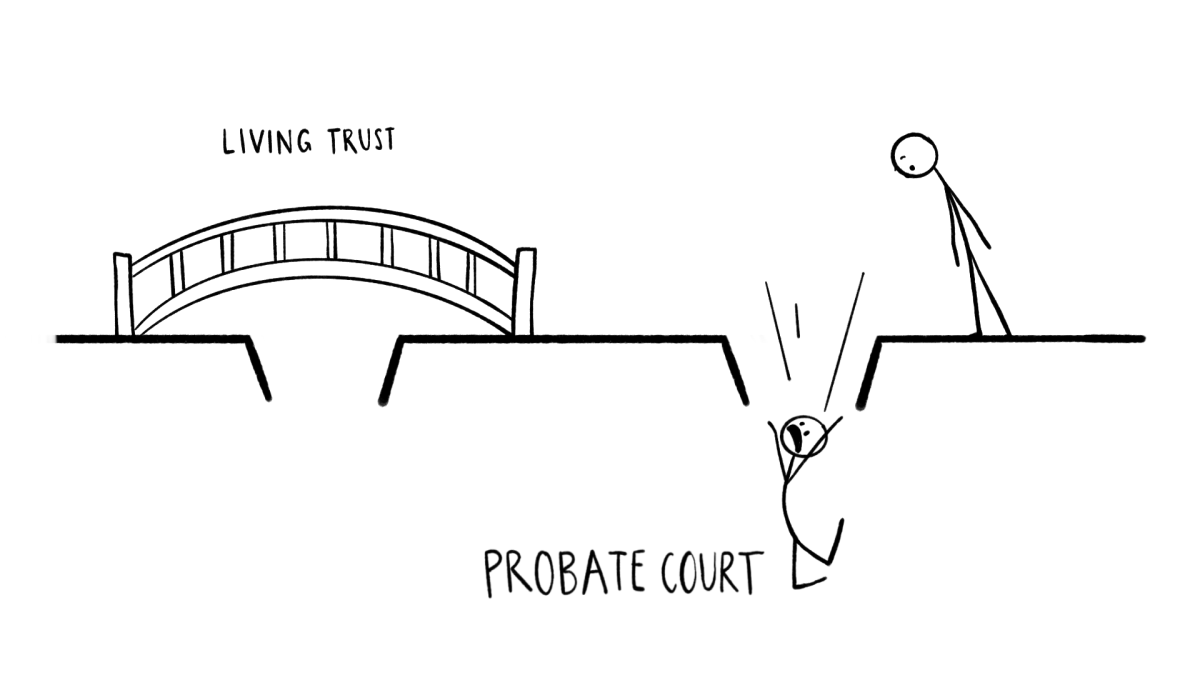

Well, basic living trusts will still go to probate for 2 reasons.

1st Reason:

When you created the trust, the assets you own in your name were not put into the bucket.

The attorney didn’t show you how to do it and then you died with the assets still in your name. The living trust the attorney created was empty and it just sat there until you died.

So you paid the attorney to create a trust for you that didn’t work. And now you died with the assets in your name and your family is now paying for the probate.

You and your family paid twice.

We call that the Double Probate.

2nd Reason why living trusts go to probate:

Years after creating the living trust, the new assets you now own were not put into the bucket.

Let’s say you put your home into the trust along with all your other assets. So far so good. If you were to die right after that, everything would be fine and there’d be no probate.

But let’s say you didn’t die right away, in fact you’re probably going to live for many years after you created the living trust. And during those years, let’s say you sold your home and bought a new home. But the title company put the new home in your name, not your living trust. This is very common!

Because of that, when you die, there was a probate on the home.

So you had to pay the attorney for the living trust initially, and now your children had to pay the attorney for the probate when you died.

You and your family paid twice.

Once again, we call this Double Probate.

How do We Help You Avoid the Double Probate?

Like we’ve talked about, during the year, you might buy a new home or open a new bank account.

When you are on our Gold Membership Program, you are sent a yearly annual packet.

In this packet is an Asset Detail Report listing off your assets including who owns the asset and who is the current beneficiary.

The Asset Detail Report is vital to your success.

During the year, if you need to update the Asset Detail Report, there is no fee to discuss the report and your funding with your funding coordinator. They will help you get your assets transferred to your trust and they will verify that you did it correctly. Then they will update your Asset Detail Report.

That’s our secret to stopping the Double Probate from hitting your family.

Call our office today or sign up on our website to get a FREE consultation of how you can stop the DOUBLE PROBATE from effecting your family!