Wondering how to protect your business as part of your estate plan?

For many entrepreneurs, the question of what happens to their company after they’re gone looms large. This is where trusts and Limited Liability Companies (LLCs) intersect. A trust is a legal tool that holds assets for beneficiaries, while an LLC, or limited liability company, shields business owners from personal liability. But can a trust own an LLC? The answer might surprise you and open new possibilities for your legacy. This ownership structure can safeguard your business assets from creditors and ensure a smooth handover to your heirs, bypassing the mess of probate.

Fales Law Group’s dedicated attorney understands all the ins and outs of this matter to provide you with exceptional professional support. Contact us for a free consultation to secure the future of your loved ones.

In this article, we’ll explore whether a trust can own an LLC, the reasons to use this strategy, and its key advantages and challenges.

How Can a Trust Own an LLC?

So, can a trust own an LLC?

Yes. Understanding how it works is key to leveraging this strategy. The process begins with transferring ownership of the LLC to the trust, effectively naming the trust as the member or owner of the LLC’s operating agreement. This can happen during the grantor’s lifetime with a revocable trust or as part of estate planning with an irrevocable trust. Either way, the trust becomes the legal entity controlling the LLC, managing its assets per the trust’s terms.

For a revocable living trust, the grantor (often, this is the business owner) sets it up and transfers the LLC into it while retaining full control. They can amend or revoke the trust as needed, making it flexible. Upon their death, the trust dictates how the LLC passes to beneficiaries, avoiding probate. Conversely, an irrevocable trust involves a permanent transfer. Once the LLC is placed in it, the grantor relinquishes control, which can offer tax benefits or shield the business from creditors.

Consider an example: A small business owner asks, “Can a trust own an LLC to protect my family?” They create a trust, name it as the LLC’s owner, and specify that their children inherit the profits over time. The trustee manages the LLC until the kids are ready to take over. Legally, this requires updating the LLC’s operating agreement and filing any necessary paperwork with the state, ensuring compliance with local regulations.

The mechanics hinge on proper setup. An attorney drafts the trust, the LLC ownership is reassigned, and the trust’s terms align with the grantor’s goals. Whether for succession or protection, can a trust own an LLC isn’t just a question. It’s an actionable plan that blends business and estate planning seamlessly.

Reasons a Trust Should Own an LLC

As a business owner, you’ve worked hard to build your LLC—but have you thought about its future? Trust might be the key to protecting your company and securing your legacy. A trust can own an LLC, and it’s a strategy gaining traction for good reason. By placing your LLC in a trust, you can shield it from uncertainties, streamline its transfer to heirs, and align it with your estate plan.

Here are 4 compelling reasons a trust should own an LLC, from asset protection to tax benefits, showing why this powerful combo could be the smart move for your business.

1. Estate Planning Advantages

If you own an LLC and don’t have a solid estate plan, your heirs can face delays, legal issues, and high legal costs after you pass away. Placing your LLC in a revocable or irrevocable trust can prevent these issues.

Your LLC passes to your heirs smoothly, without court involvement. This prevents family disputes and keeps your business running with no confusion over ownership after your death.

2. Asset Protection with Limited Liability

Limited liability of using an LLC protects your assets from business lawsuits. However, adding a trust can provide more protection because creditors can’t go after your LLC’s assets to pay personal debts. This situation protects your business from lawsuits. Especially if you’re using an irrevocable trust, it can make the LLC harder to seize.

Furthermore, living trusts are not public records, so your business ownership stays confidential. You can add another layer of protection against lawsuits from tenants or creditors by transferring the LLC to a trust. If someone sues you, your assets remain safe.

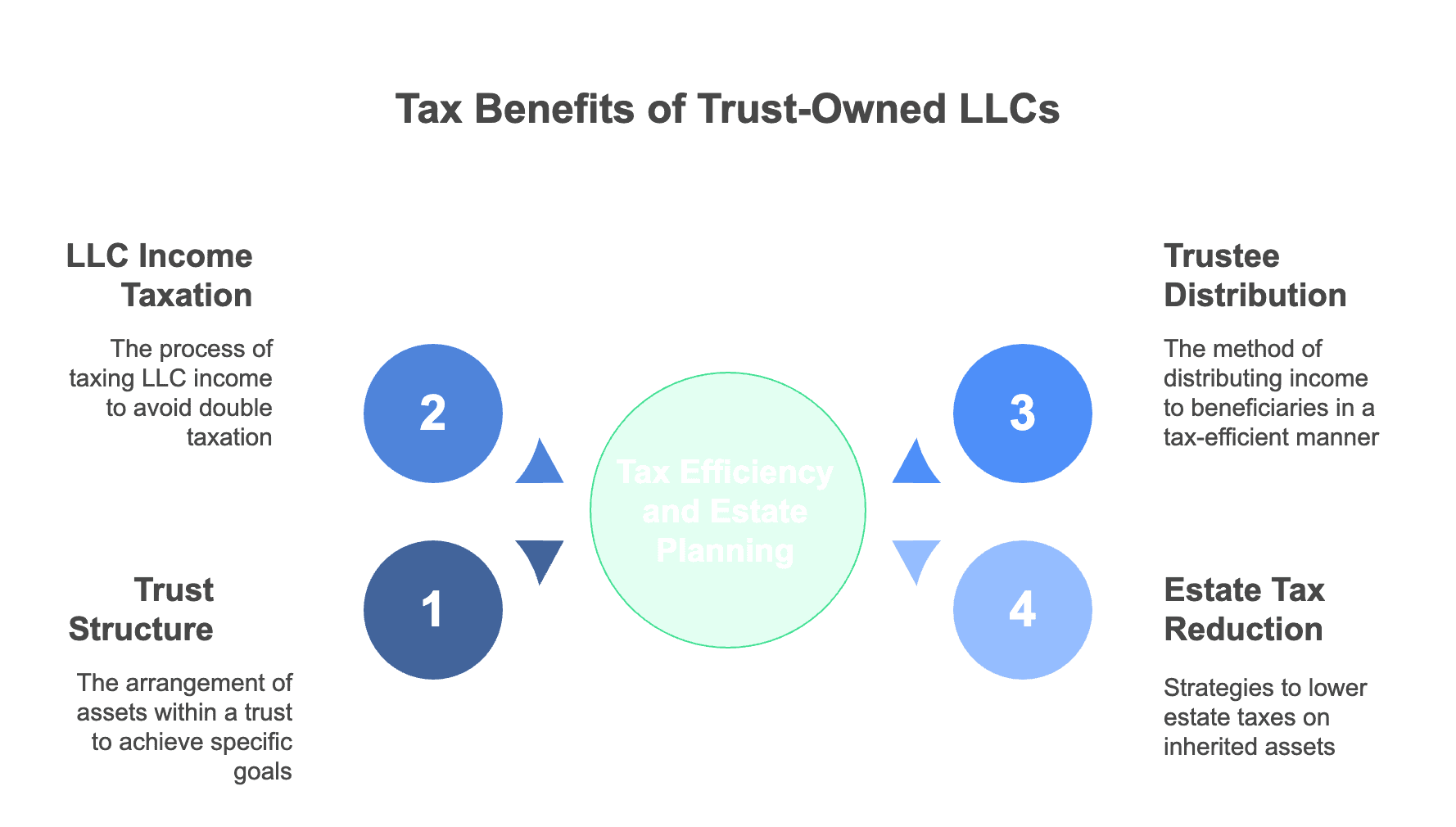

3. Tax Benefits & Financial Flexibility

Taxes are always a major concern for business owners, and a trust-owned LLC can help reduce taxes, depending on how it’s structured. You can also reduce estate taxes because your assets in certain trusts may not count toward taxable estate value.

In most cases, the LLC’s income is taxed only once, avoiding double taxation. A trustee can distribute income to beneficiaries in tax-efficient ways. So, you can transfer your LLC into an irrevocable trust to lower estate taxes. When you pass away, your children inherit the business without paying huge taxes.

4. Business Continuity & Succession Planning

If you own a business, you need a plan for what happens when you retire or pass away. Without a clear succession plan, your LLC could face legal disputes, leadership confusion, or closure. If your trust owns an LLC, it automatically transfers ownership to the right person.

Also, it avoids business disruptions and eliminates the need to pause operations due to probate delays. This estate planning keeps your business in the family, and you can set conditions for heirs to inherit the LLC. Because of this planning, the transition becomes smooth and stress-free.

Benefits of a Trust Owning an LLC

One major benefit is asset protection. By placing the LLC in a trust, especially an irrevocable one, the business assets are shielded from personal creditors or estate disputes. If a lawsuit targets the grantor’s finances, the LLC’s value often remains out of reach, safeguarding the company they’ve built.

Another compelling reason a trust can own an LLC is seamless succession. Without trust, an LLC might get tangled in probate after the owner’s death—a public, costly, and time-consuming process. A trust bypasses this, transferring ownership to beneficiaries smoothly and privately. For example, a revocable trust can name heirs as successors, ensuring the business continues without interruption.

Tax advantages also make this structure appealing. While a revocable trust offers no immediate tax breaks, an irrevocable trust can reduce estate taxes by removing the LLC from the grantor’s taxable estate. This can save significant amounts for high-value businesses.

For those who value control and flexibility, a revocable trust shines. The grantor can manage the LLC as usual during their lifetime, tweaking the trust as circumstances change. Only after their passing does it lock in, balancing hands-on oversight with long-term planning.

Finally, there’s an emotional payoff: peace of mind. Knowing their business is protected and their legacy secure, owners can rest easy. Whether it’s shielding assets or ensuring a smooth handover, can a trust own an LLC isn’t just a legal question—it’s a path to confidence. These benefits make it a standout choice for savvy entrepreneurs planning ahead.

Potential Challenges with an LLC Owned by a Trust

Owning an LLC through a trust has a lot of benefits, but there are a few challenges to be aware of. Some of these are:

Legal Complexities

Setting up a trust can face some legal complications in some cases. If it’s not done correctly, it can cause problems afterward. The best way to avoid legal issues is to work with an experienced estate attorney who can guide you through the process accurately.

Tax Implications

Different trusts require different tax implications according to your state. If you’re not careful, you could end up with unexpected tax burdens. Your tax advisor can help you choose the best structure for your trust and LLC so you don’t run into hidden surprises.

Choosing the Right Trustee

A trustee is responsible for managing the trust while keeping control over the LLC. If you pick the wrong person, they can mismanage your business easily. So, you should choose someone who is not only trustworthy but also understands business and finances. You can also appoint a professional trustee to make sure your business runs smoothly.

Securely Put Your LLC in Your Trust Now

Placing your LLC in a trust can protect your business, minimize taxes, and ensure a smooth transition for your heirs. It can also help you avoid probate, protect assets, and provide long-term stability. However, your situation can be different in many ways. Before making any final decision, you can consult with an estate planning attorney to structure your trust and LLC.

Fales Law Group provides the ultimate defense against legal complications and other hassles through professional guidance. You can get all the benefits of owning an LLC with your trust in the right way. Schedule a free consultation now and explore the way to win peace of mind with us.

Common Questions

Frequently Asked Questions

What are the main types of living trusts, and how do they differ?

There are two primary types of living trusts:

- Revocable Living Trust: Allows you to retain full control over your assets during your lifetime, with the flexibility to modify or revoke the trust as your circumstances change.

- Irrevocable Living Trust: Once established, this trust cannot be altered or revoked, effectively removing the assets from your estate, which can offer protection from creditors and potential estate tax benefits.

Who should I designate as the trustee and beneficiaries of my living trust?

As the grantor, you can serve as the initial trustee, maintaining control over your assets. It’s essential to appoint a successor trustee who will manage the trust upon your incapacity or death. Beneficiaries are individuals or entities you designate to receive the assets held in the trust.

What types of assets can be placed into a living trust?

A living trust can include various assets, such as:

- Real Estate: Primary residences, vacation homes, and rental properties.

- Bank Accounts: Checking, savings, and money market accounts.

- Investments: Stocks, bonds, mutual funds, and other investment accounts.

- Business Ownership: Interests in privately owned businesses.

Personal Property: Valuable items like jewelry, artwork, and collectibles.

What are common mistakes to avoid when setting up a living trust?

Common pitfalls include:

- Not Funding the Trust: Failing to transfer assets into the trust renders it ineffective.

- Choosing the Wrong Trustee: Selecting an unreliable or unqualified trustee can lead to mismanagement.

- Neglecting to Update the Trust: Not revising the trust to reflect life changes can cause discrepancies.

- Improper Execution: Not signing the trust document in accordance with state laws can invalidate the trust.

- Overlooking Tax Implications: Not considering potential tax consequences can affect the estate’s value.

Why is it important to consult with an estate planning attorney when creating a living trust?

An estate planning attorney ensures that your living trust is tailored to your specific needs, complies with state laws, and helps you avoid common mistakes that could undermine your estate planning goals.