So here is a drawing of a woman I call “Bambi the Blonde” and the question is, is she the person your husband remarries after you die?

Well, we don’t know.

If you are married, your living trust will likely blow up if you die and your husband gets remarried–maybe she’s cute, maybe she’s not–but that doesn’t matter because she just blew up your basic living trust by getting married to your husband.

The best example of this, is the story of John and Betty.

They had a basic living trust prepared and they thought when they died everything would go to their daughters. But not long after Betty died, John remarried.

Now, when he died, the home and almost all their assets went to his new wife. The daughters were accidentally disinherited.

So what happened here?

Because John remarried after Betty died, the assets over time became marital assets. If they lived in a community property state like Arizona, Nevada or Idaho, for example, then it’s even easier for the new spouse to become the owner of the assets.

To make matters worse, John did not update his trust after he got remarried, and now the new spouse was entitled to at least ⅓ of everything.

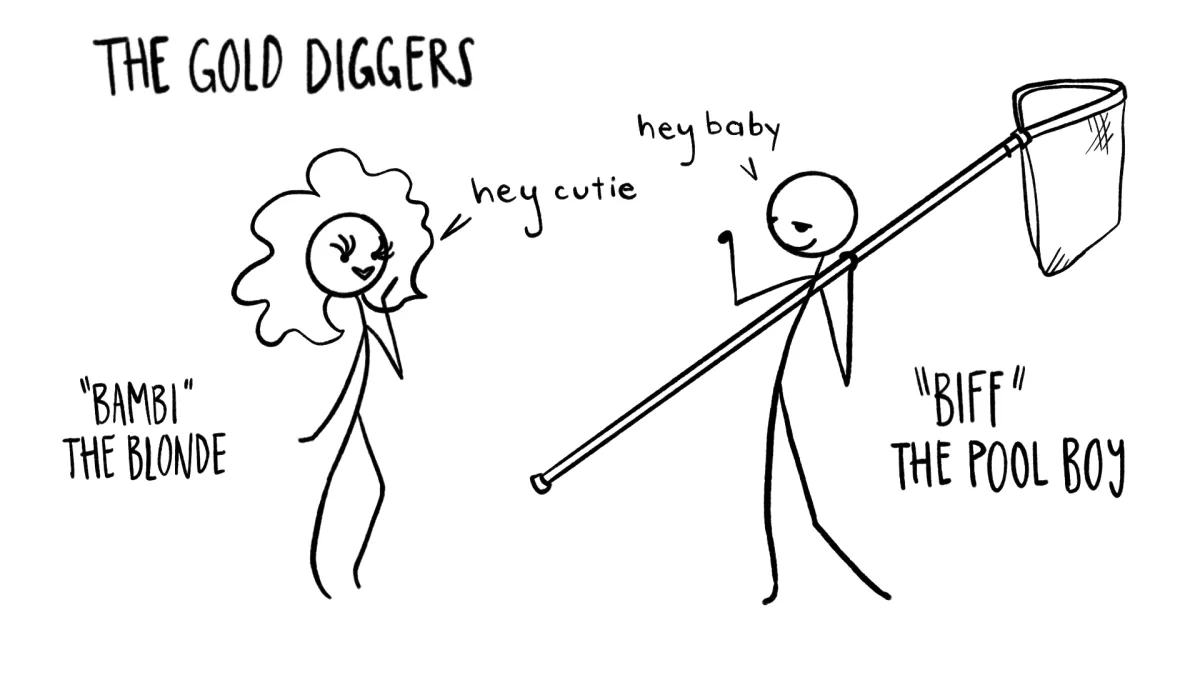

It could happen the other way around. If John died first, and Betty remarried Biff the Pool Boy then their daughters would suffer the same disinheritance.

You can put certain provisions in the living trust that help prevent this from happening. Basic living trusts normally don’t consider this, but it is vital if you don’t want to accidentally disinherit your kids.

Our office always seeks to protect you and your family from Gold Diggers.

“my husband is never going to get remarried once I’m gone”

If a person never thinks they will never remarry they probably will be the most vulnerable to someone making strong advances. Even for those who admit the possibility, you are the most vulnerable after the death of a spouse.

Gold Digger planning guarantees three things:

- If the Gold Digger dies, your spouse doesn’t have to deal with the Gold Digger’s kids.

- If your spouse dies, the Gold Digger can’t run off with the money and disinherit your kids.

- If your spouse and the Gold Digger get a divorce, the Gold Digger can’t run off with ½ of the assets.

If you die and your spouse remarries, sooner or later the assets are going to get comingled.

The longer the marriage, the more likely the assets will become joint or community property. The more aggressive the Gold Digger, the more likely this will happen over a short period of time.

The Gold Digger can be very manipulative.

The surviving spouse is looking for an emotional rebound. When comingling happens, the character of the assets changes from separate property to marital or community property.

My Gold Digger planning is simple: REQUIRE the surviving spouse to sign a prenuptial agreement or else they lose control of the assets. The trust is designed with a poison pill provision—a provision that you and your spouse agree to while they are both alive.

The provision is dormant and has no ramifications unless you die and your spouse goes to get remarried. Then, like a poison pill you swallowed years ago, the potent provisions kick in.

The provision is worded in the negative: if you get remarried you lose control of all the assets unless you sign a prenup with the provisions outlined above.

By you and your spouse agreeing to it before either one of you dies, there is no embarrassment when asking the Gold Digger for the prenuptial agreement.

It wasn’t done with that particular Gold Digger in mind (well, maybe but that’s not what you tell the Gold Digger), so it’s not about love or trust. It’s about something you agreed to do while your spouse was alive and there’s nothing you can do about it now.

I’ve always been able to get my client’s fiancé to sign a prenuptial agreement when there is a provision in the trust requiring it.

The converse is also true:

I’ve never been able to have a client get a prenup after his/her spouse died and now there is a remarriage.

So when my clients tell me that they will never get remarried, I tell them that is not a statement they can guarantee; whereas, in my life, I never have to worry about it because my wife, my children and I are protected.

Call our office today at (702) 804-0024 or sign up on our website for a FREE consultation of how you can protect you and loved ones from GOLD DIGGERS!