Did you know setting up a living trust is the smartest way to protect your assets and make life easier for your loved ones? Moreover, you can easily set up a living trust to avoid probate and handle your estate according to your wishes. However, you must avoid common mistakes that can cause legal problems, delays, or unnecessary costs.

Your living trust holds your real estate, bank accounts, and investments. It can be passed on to beneficiaries according to your instructions. A living trust can avoid probate, provide more privacy than a will, and smooth asset distribution.

Professional legal help can secure your legacy in the best possible way. Fales Law Group is the trusted choice for providing the required support and confidence.

Contact us today to make sure your living trust is set up correctly.

In this blog post, we’ll disclose how to set a living trust in simple steps and how to avoid 10 common mistakes.

How to Set Up a Living Trust in 5 Simple Steps?

While setting up a trust sounds overwhelming, it’s pretty straightforward. Here’s how to set up a living trust in five simple steps:

1. Decide What Type of Trust You Need

Before creating a trust, you need to choose the right one. There are two main types of living trust:

- Revocable Living Trust: It lets you keep full control over your assets while you’re alive. You can update, change, or even cancel the trust anytime.

- Irrevocable Living Trust: This type of living trust cannot be changed. It removes assets from your estate, which can help protect them from creditors and reduce estate taxes.

2. Choose a Trustee and Beneficiaries

Your trust needs trustees and beneficiaries to work properly. Here’s what they do:

- Trustee: You’ll need to pick a successor trustee who will take over when you pass away or if you become unable to manage your life or financial affairs.

- Beneficiaries: You can divide your assets among your children or give specific amounts to different people.

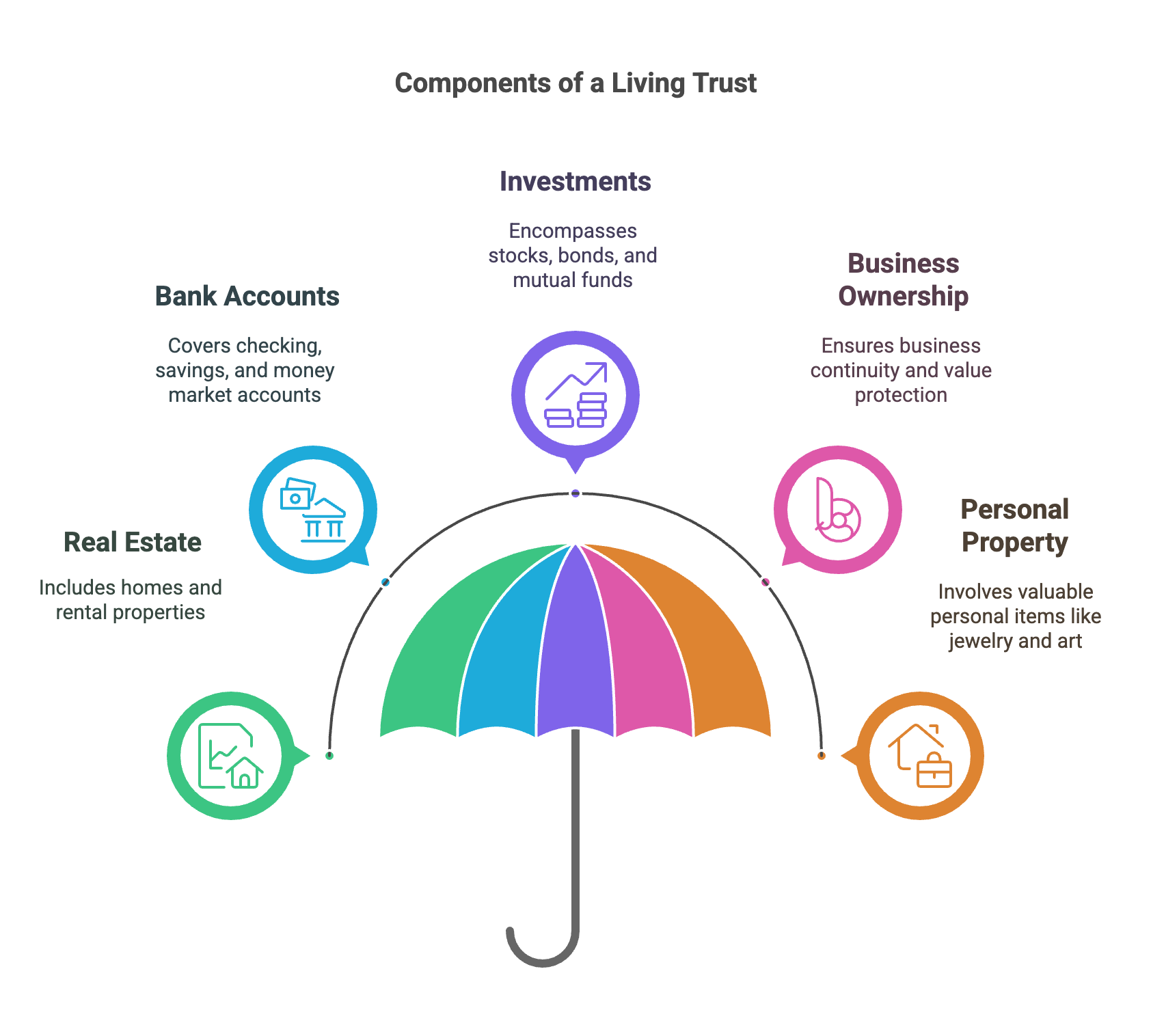

3. List the Assets You Want in the Trust

You’ll need to decide what to include in your trust. You can put the assets into the trust that you want to pass smoothly to your heirs without probate. Here are some common assets people put in a living trust:

Real Estate

This includes your primary residence, vacation homes, and any rental properties. Placing real estate in a trust can help avoid probate and ensure a smooth transfer of ownership to beneficiaries.

Bank Accounts

You can include checking accounts, savings accounts, and money market accounts. These accounts can be retitled in the name of the trust to facilitate direct access for the trustee.

Investments

This category encompasses stocks, bonds, mutual funds, and other investment accounts. Including these assets in a trust allows for organized management and seamless transfer upon your passing.

Business Ownership

If you own a business, placing it in a trust can provide continuity and protect its value for your beneficiaries. This ensures that business operations can continue without disruption in the event of your incapacity or death.

Personal Property

Valuable personal items such as jewelry, artwork, collectibles, and other tangible assets should be included to ensure their safekeeping and proper distribution to heirs.

4. Create and Sign the Trust Document

To make the trust document official and legally binding, you must create and sign the document before a notary. Here are the options and necessary steps you need to take:

Creating the Trust Document

This involves drafting the legal document that outlines the terms of your trust. You have a few options here:

- Hire an Attorney: An estate planning attorney can create a trust document tailored to your specific needs and goals. This is especially important for complex situations.

- Use an Online Legal Service or Software: Services like LegalZoom can help you create a trust document by answering questions and filling in forms.

- Use a Form: You can purchase a living trust form and complete it. However, be cautious with generic forms as they may not comply with your state’s laws or fully address your needs.

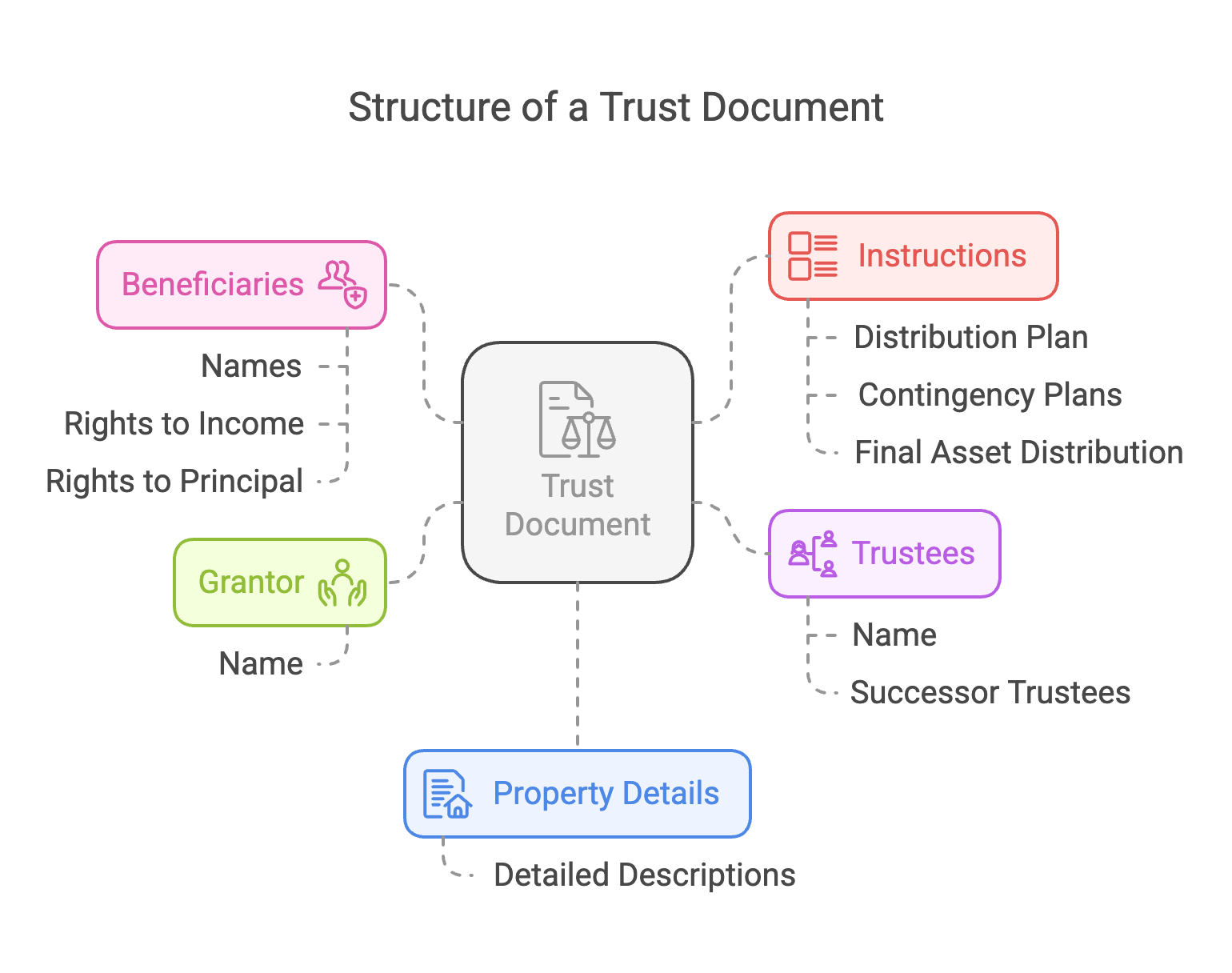

Key Elements of the Trust Document

The document will include essential information such as:

- Your name (as the grantor).

- The names of your trustees and successor trustees.

- The names of your beneficiaries.

- Detailed descriptions of the property you intend to include in the trust.

- Instructions on who receives what when you pass away.

- Beneficiary rights to income and principal.

- Trustee powers and limitations.

- Trustee succession order.

- Contingency plans if beneficiaries die before you.

- Instructions for final asset distribution.

Signing the Trust Document

To create a valid living trust, you must sign the trust document.

Notarization

Most states require your signature to be notarized before your trust is enforceable. You can find a notary public at your bank, some print shops, or through online notary services. Having the document notarized serves as evidence that your signature is genuine. In Florida, two witnesses are required.

Review

Before signing, carefully review the document to ensure it accurately reflects your wishes. It’s best to have an estate planning attorney review the form to ensure it complies with your state’s laws and supports your best interests.

After creating and signing the trust document, the next crucial step is to transfer property into the trust to “fund” it.

5. Transfer Your Assets Into the Trust

You must transfer ownership of your assets to the trust, or they’ll go through probate. For real estate, you can update your property deed to list the trust as the new owner. In the US, some banks let you change the trust’s ownership, while others require you to open new accounts in the trust’s name.

Avoid 10 Mistakes to Perfectly Setting Up a Living Trust

Most of you can make simple mistakes that could lead to probate, legal disputes, or financial losses. Here are 10 common mistakes to avoid and how to do it right.

- Failing to Fund the Trust: If you don’t fund your trust in time, your assets could still go through probate. Funding a trust changes the ownership of your assets from your name to the trust’s name.

- Choosing the Wrong Trustee: The wrong trustee choice can cause mismanagement, conflicts, or legal issues. You can pick someone trustworthy and financially responsible. You can also consider a neutral third party.

- Not Updating the Trust: If you don’t update your living trust regularly, your assets could end up in the wrong hands. Your trust should always reflect your current wishes. You can update it after marriage or divorce, birth or adoption of a child, death of a beneficiary or trustee, etc.

- Overlooking State-Specific Laws: Not all trusts and laws work the same way in every state. Laws can vary in different states, and if you move, your trust may not be valid or require adjustments. So, you should always check with an estate planning professional if you move to make sure your trust still works as before.

- Forgetting Contingent Beneficiaries: Contingent beneficiaries provide a backup plan in case of unexpected events. If your primary beneficiary passes away before you and there’s no backup, your assets could end up in probate.

- Not Considering Taxes Rightly: Many people assume a trust will simply eliminate taxes, but that’s not true in some cases. However, some states have their own estate or inheritance taxes that could apply.

- Using Vague or Incomplete Language: If your trust instructions are too vague, it could lead to legal disputes between family members. A well-written trust should leave no room for confusion.

- Assuming a Living Trust Covers Everything: A living trust is a powerful document, but it doesn’t cover your all assets. It doesn’t cover retirement accounts (401(k), IRA), life insurance policies, and jointly owned property.

- DIY Trusts Without Legal Guidance: DIY trusts can impose risks because state laws are different in every state. Also, some essential details can be missing in these DIY trusts. For complex estates, consulting an estate planning attorney is worth it.

- Losing Track of Important Documents: Your perfect trust won’t help if no one can find it. You can store your trust documents in a fireproof safe, with your estate planning attorney, or in a secure digital storage system.

Set Up Your Living Trust With a Professional Attorney

A living trust is the perfect solution to protect your assets and make sure your loved ones avoid the hassle of probate. However, setting up a living trust the right way is significant for all of you. Your simple mistakes like forgetting to fund the trust, choosing the wrong trustee, or not keeping it updated can cause trouble in the future.

So, you must avoid these mistakes beforehand and properly fund your trust, choose a reliable trustee, and keep it updated as life changes. Consulting an estate planning attorney can help you get everything right.

Fales Law Group can take responsibility for building a legally effective living trust for you in a stress-free way. Contact us today for a free consultation and immediately secure your legacy and loved ones’ future.

Common Questions

Frequently Asked Questions

What is the primary purpose of setting up a trust?

A trust serves multiple purposes, including estate planning, tax efficiency, charitable giving, and protecting loved ones. It allows you to control how your assets are managed and distributed, both during your lifetime and after your death. Trusts can help avoid probate, provide privacy, and offer potential tax benefits.

How do I choose the right type of trust?

Selecting the appropriate trust depends on your specific goals:

- Revocable Trust: Offers flexibility and allows you to make changes during your lifetime; it helps avoid probate but doesn’t provide asset protection.

- Irrevocable Trust: Provides tax benefits and shields assets from creditors but cannot be easily altered once established.

- Special Needs Trust: Supports disabled beneficiaries without affecting their eligibility for government assistance.

- Charitable Trust: Enables donations to charity while reducing estate taxes.

Consulting with an estate planning attorney can help determine the best option for your situation.

Who should I appoint as a trustee?

The trustee manages the trust’s assets and ensures your instructions are followed. You can choose a family member, friend, or a professional trustee such as an attorney or financial institution. Consider factors like trustworthiness, financial acumen, and the ability to handle legal responsibilities when making your selection.

What assets can be placed into a trust?

Various assets can be transferred into a trust, including real estate, bank accounts, investments, and personal property. It’s essential to retitle these assets in the name of the trust to ensure they are properly included. Some assets, like certain retirement accounts, may have tax implications when transferred, so it’s advisable to consult with a financial professional.

What are the steps involved in setting up a trust?

The process of establishing a trust typically involves:

- Determine the Purpose: Clarify your goals for the trust.

- Choose the Type of Trust: Select a trust that aligns with your objectives.

- Select a Trustee: Appoint a reliable individual or institution to manage the trust.

- Identify and List Assets: Compile a comprehensive list of assets to include in the trust.

- Draft the Trust Document: Work with an estate planning attorney to create the legal document outlining the trust’s terms.

- Fund the Trust: Transfer ownership of the identified assets into the trust.

- Review and Update: Regularly review the trust to ensure it continues to meet your needs and complies with current laws.

What role does an estate planning attorney play in the process?

An estate planning attorney provides expert guidance, ensures compliance with local laws, drafts necessary documents, and helps you navigate the complexities of protecting your assets and wishes.